Moorea Fund - Global Conservative Allocation Portfolio

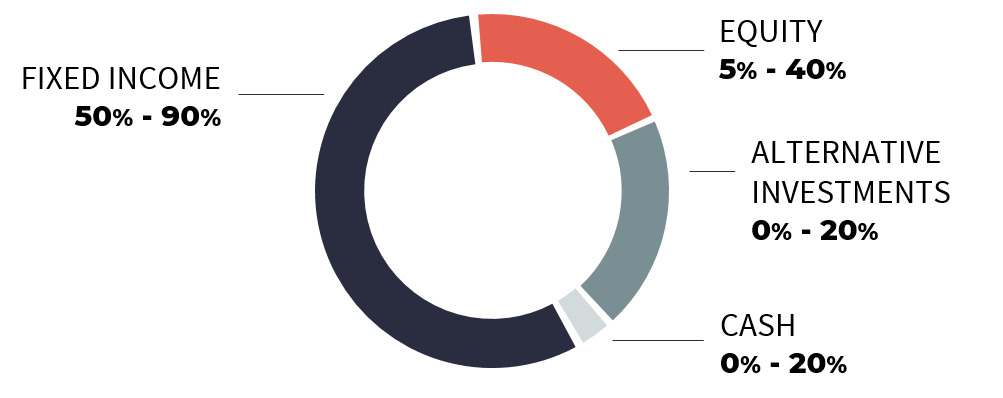

The investment objective of the fund is to seek to provide medium term growth to investors from a

diversified portfolio of investments. The portfolio is actively managed, providing an exposure to fixed income, equities and alternative investments, through mutual funds and direct holdings.

The overall risk of the fund is intended to be consistent with that of a defensive portfolio.

Able to navigate in changing market conditions and seeks to capture investment opportunities.

Key features

A strategy that aims to deliver capital growth and regular income over a medium term investment horizon through a selection of mutual funds and direct holdings.

An active exposure to a wide range of asset classes

The fund adopts a multi-asset approach, which enables it to navigate in challenging market environments. The portfolio management team seeks to identify strategy drivers and opportunities by taking active portfolio management decisions:

- At a global level across financial markets: at the asset class, country and currency level,

- Within each specific market: through sector, subsector and individual security selection.

The fund implements an integrated global approach that aims to produce above average results in a cautious way. As such, the portfolio management team benefits from

Societe Generale Private Banking global resources including strategists, as well as asset classes and quantitative experts.

A rigorous investment process

The fund employs a methodology which involves:

- A Top Down approach, providing an analysis of the current and expected macroeconomic environment (valuations, market momentum and technical indicators)

that will lead to asset allocation adjustments.

- A Bottom Up approach, leading to the selection of mutual funds or specific assets in open architecture, within a clearly-defined risk controlled framework.

| Share class | |

|---|---|

| Category | Multi-asset |

| Risk profile | 2 |

| Recommended investment period | 3-5 years |

| Isin Code | LU1506378568 |

| Investor profile | Retail |

| Currency | EUR |

| Dividend policy | Accumulation |

| Net Asset Value frequency | Daily |

| Initial Net Asset Value | 250 EUR |

| Net Asset Value date | 17/01/2025 |

| Net Asset Value | 283.51 |

| Monthly report | |

| KIID | |

| Tax publication | |

| Category | Multi-asset |

| Risk profile | 2 |

| Recommended investment period | 3-5 years |

| Isin Code | LU1506378642 |

| Investor profile | Retail |

| Currency | USD |

| Dividend policy | Accumulation |

| Net Asset Value frequency | Daily |

| Initial Net Asset Value | 250 USD |

| Net Asset Value date | 17/01/2025 |

| Net Asset Value | 330.68 |

| Monthly report | |

| KIID | |

| Tax publication | |

| Category | Multi-asset |

| Risk profile | 2 |

| Recommended investment period | 3-5 years |

| Isin Code | LU1506378998 |

| Investor profile | Institutional |

| Currency | EUR |

| Dividend policy | Accumulation |

| Net Asset Value frequency | Daily |

| Initial Net Asset Value | 250 EUR |

| Net Asset Value date | 17/01/2025 |

| Net Asset Value | 299.67 |

| Monthly report | |

| KIID | |

| Category | Multi-asset |

| Risk profile | 2 |

| Recommended investment period | 3-5 years |

| Isin Code | LU1558111024 |

| Investor profile | Retail |

| Currency | EUR |

| Dividend policy | Distribution |

| Net Asset Value frequency | Daily |

| Initial Net Asset Value | 250 EUR |

| Net Asset Value date | 17/01/2025 |

| Net Asset Value | 254.51 |

| KIID | |

| Category | Multi-asset |

| Risk profile | 2 |

| Recommended investment period | 3-5 years |

| Isin Code | LU1664189096 |

| Investor profile | Mandate |

| Currency | EUR |

| Dividend policy | Accumulation |

| Net Asset Value frequency | Daily |

| Initial Net Asset Value | 250 EUR |

| Net Asset Value date | 17/01/2025 |

| Net Asset Value | 284.50 |

| KIID | |

| Tax publication |

A multi-asset strategy

Performances

The investment strategy of the fund has been modified in February 2020.

Performance scenarios

Data as of //0/24/0

Hypothetical 10000 EUR investment

| Scenarios | 1 year | 5 years * |

|---|---|---|

| Stress | ||

| What you might get back after costs (EUR) | € 6,575.319 | € 6,514.127 |

| Average return each year (%) | -34.25% | -8.22% |

| Unfavorable | ||

| What you might get back after costs (EUR) | € 8,347.196 | € 8,813.284 |

| Average return each year (%) | -16.53% | -2.49% |

| Moderate | ||

| What you might get back after costs (EUR) | € 9,627.267 | € 10,022.464 |

| Average return each year (%) | -3.73% | 0.04% |

| Favorable | ||

| What you might get back after costs (EUR) | € 10,896.198 | € 10,574.960 |

| Average return each year (%) | 8.96% | 1.12% |

*Recommanded holding period

Download

Performance scenarios

Data as of //0/24/0

Hypothetical 10000 USD investment

| Scenarios | 1 year | 5 years * |

|---|---|---|

| Stress | ||

| What you might get back after costs (USD) | $ 6,583.407 | $ 6,489.166 |

| Average return each year (%) | -34.17% | -8.29% |

| Unfavorable | ||

| What you might get back after costs (USD) | $ 8,507.476 | $ 9,124.767 |

| Average return each year (%) | -14.93% | -1.82% |

| Moderate | ||

| What you might get back after costs (USD) | $ 9,786.741 | $ 11,059.893 |

| Average return each year (%) | -2.13% | 2.04% |

| Favorable | ||

| What you might get back after costs (USD) | $ 10,974.844 | $ 11,950.903 |

| Average return each year (%) | 9.75% | 3.63% |

*Recommanded holding period

Download

Performance scenarios

Data as of //0/24/0

Hypothetical 10000 EUR investment

| Scenarios | 1 year | 5 years * |

|---|---|---|

| Stress | ||

| What you might get back after costs (EUR) | € 6,575.433 | € 6,514.628 |

| Average return each year (%) | -34.25% | -8.21% |

| Unfavorable | ||

| What you might get back after costs (EUR) | € 8,398.956 | € 8,918.551 |

| Average return each year (%) | -16.01% | -2.26% |

| Moderate | ||

| What you might get back after costs (EUR) | € 9,683.040 | € 10,310.009 |

| Average return each year (%) | -3.17% | 0.61% |

| Favorable | ||

| What you might get back after costs (EUR) | € 10,963.482 | € 10,927.409 |

| Average return each year (%) | 9.63% | 1.79% |

*Recommanded holding period

Download

Performance scenarios

Data as of //0/24/0

Hypothetical 10000 EUR investment

| Scenarios | 1 year | 5 years * |

|---|---|---|

| Stress | ||

| What you might get back after costs (EUR) | € 6,585.261 | € 6,516.710 |

| Average return each year (%) | -34.15% | -8.21% |

| Unfavorable | ||

| What you might get back after costs (EUR) | € 8,345.778 | € 8,731.919 |

| Average return each year (%) | -16.54% | -2.68% |

| Moderate | ||

| What you might get back after costs (EUR) | € 9,620.140 | € 10,032.909 |

| Average return each year (%) | -3.8% | 0.07% |

| Favorable | ||

| What you might get back after costs (EUR) | € 11,095.191 | € 10,649.139 |

| Average return each year (%) | 10.95% | 1.27% |

*Recommanded holding period

Download

Performance scenarios

Data as of //0/24/0

Hypothetical 10000 EUR investment

| Scenarios | 1 year | 5 years * |

|---|---|---|

| Stress | ||

| What you might get back after costs (EUR) | € 6,575.577 | € 6,514.298 |

| Average return each year (%) | -34.24% | -8.21% |

| Unfavorable | ||

| What you might get back after costs (EUR) | € 8,359.692 | € 8,838.651 |

| Average return each year (%) | -16.4% | -2.44% |

| Moderate | ||

| What you might get back after costs (EUR) | € 9,638.331 | € 10,067.276 |

| Average return each year (%) | -3.62% | 0.13% |

| Favorable | ||

| What you might get back after costs (EUR) | € 10,912.916 | € 10,629.239 |

| Average return each year (%) | 9.13% | 1.23% |

*Recommanded holding period

Download

Past performance should not be seen as an indicator of future performance.

Associated risks

- Investments may be subject to market fluctuations and the price and value of investments and the income derived from them can go down as well as up. Your capital may be at risk and you may not get back the amount you invest.

- Operational Risk: It refers to a failure or delay in the system, processes and controls of the fund or its service providers which could lead to losses for the fund.

- Market Risk: Refers to the possibility for an investor to experience losses due to the overall performance of the financial markets.

- Liquidity Risk: Refers to the possibility that the fund may loose money or be prevented from earning capital gains if it cannot sell a security at the time and price that is most beneficial to the fund and may be unable to raise cash to meet redemption requests.

- Exchange Risk: Refers to the movements in currency exchange rates that can adversely affect the return of your investment.

- Concentration Risk: Refers to the risk of significant losses if the fund holds a large position in a particular investment that declines in value or is otherwise adversely affected, including default of the issuer.

- Emerging Markets Risk: Emerging markets may be subject to increased political, regulatory and economic instability, less developed custody and settlement practices, poor transparency and greater volatility.

Before investing, investors must be aware that certain markets may be subject to rapid fluctuations and are speculative or lacking in liquidity. Accordingly, certain assets or categories of assets listed on this website may not be appropriate for some investors. Investors are therefore urged to seek the advice of their financial advisor or intermediary in order to assess the particular nature of an investment and the risks involved and its compatibility with their individual investment profile and objectives.