CIO Views - Economic and Market Outlook for 2024

Macro-economic outlook for 2024: an overview of the challenges facing the global economy and the markets.

From surprise to surprise, what is the outlook for 2024?

The year 2023 delivered its share of surprises. The long-awaited US recession gave way to a robust economy radiating insolent health. China, on the other hand, which was expected to bounce back from the crisis, lacked dynamism, and Europe proved surprisingly resilient despite the many challenges it faced. The best news in 2023 will come from the labour market, with a marked fall in unemployment in the developed countries, partly loosening the fiscal stranglehold on governments. With monetary policies set to pivot, an election year, geopolitical risks, and disinflation, 2024 promises to bring its share of uncertainties, but also attractive opportunities. The trends are positive, and we need to know how to exploit them.

If the Fed has taken control back, inflation will only fall slowly and gradually.

The decline in inflation expectations shows that the Fed has taken back control. Breakeven inflation rates have fallen significantly and are now in line with the central bank's objectives. With real interest rates now in positive territory and the first signs of a decline in inflation, the Fed is on track to meet its objectives. The gap between key rates and market expectations is now much smaller than at the beginning of the year, confirming that the Fed has taken back control over its interest rate policy.

But while inflation seems to have passed its peak in the U.S., it may take longer to come down. Indeed, there are signs of a second round of inflation with rising unit labor costs and more sectors that are raising prices. Wage pressures are accompanied by falling labor productivity. Services, which account for a large share of GDP, will therefore naturally continue to experience price increases. Margins of companies that had previously resisted the surge in material costs should mechanically decline.

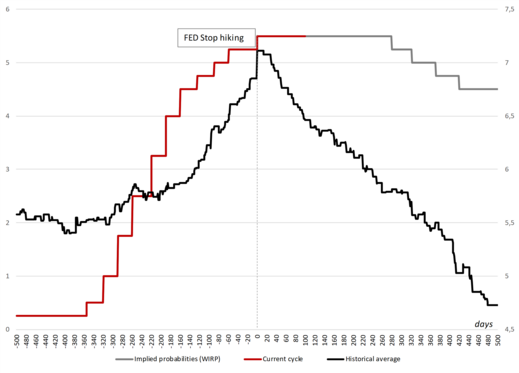

ON AVERAGE FED DOESN’T STAY AT HIGH FOR LONG

Robust US growth, against all expectations

The Biden administration can take heart from the fact that growth will remain robust in 2023. In the last quarter, the US economy grew by 3.3%, following an insolent 5% growth rate in the previous quarter, even though almost 80% of economists were forecasting a recession in 2023 at the start of the year. Growth has benefited from a strong fiscal stimulus with the combination of major infrastructure programs: the IRA (Inflation Reduction Act) and the CHIPS and Science Act. For 2024, the budget balance will not be able to contribute to a similar level, but we can be sure that it is unlikely that the United States will undertake a major fiscal consolidation effort in an election year.

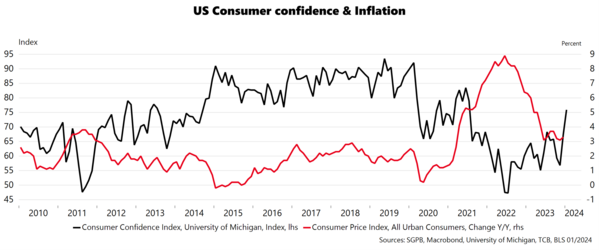

The fall in inflation has also enabled US households to enter a phase of real wage expansion. This is a much more favorable environment for households whose purchasing power had been eroded by the inflation peak in 2022. As a result, the consumer confidence index has rebounded strongly, leading to a marked acceleration in household consumption. The surplus savings accumulated during the health crisis have helped to support consumption.

In Europe, on the other hand, economic growth will slow in 2023, but where the core countries have historically done well, it is now in southern Europe that growth is strongest. Inflation and unemployment have fallen more sharply there, helping to sustain the momentum of domestic demand. Falling inflation and savings reserves should provide major support for economic activity on the Old Continent. The resilience shown in recent years should still be in evidence in 2024, but the need for governments to consolidate their budgets will put the brakes on growth.

US Consumer Confidence & Inflation

A buoyant labour markets.

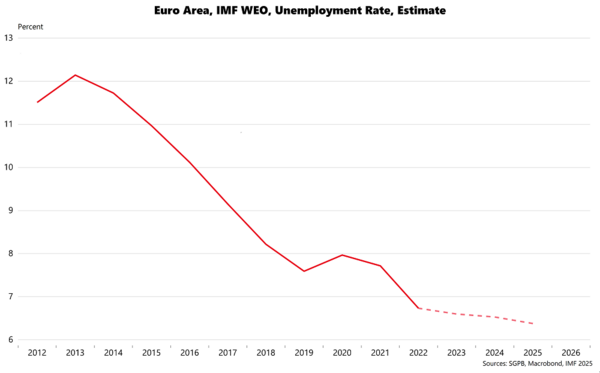

The labour market continues to enjoy favorable momentum, with the unemployment rate reaching historically low levels in the United States at 3.7% of the working population. However, the rate of employee participation in the labour market is still one percentage point lower than in March 2020, which could provide a reservoir of labour for the months ahead. In Europe, the situation has also improved considerably, with the unemployment rate at 6.4% compared with 8.4% in the summer of 2020, with a much higher participation rate. It is easy to see how far we have come, with the unemployment rate halved in ten years. Beyond the violent inflation shock, it is the good health of the labour market that is the main marker of this decade in the developed countries. While tensions on the labour market are still very much present in the United States, with a still high level of job vacancies, the strong rebound in labour productivity is offsetting the effect of wage pressures on business costs and pointing the way to a virtuous growth path.

Unemployment Rate - Euro Area

Source: Societe Generale Private Wealth Management, , Macrobond, February 2024

Past performances are not a reliable indication of future performances.

An advanced disinflation cycle paving the way for monetary policy easing.

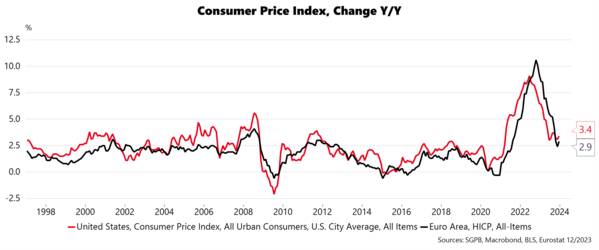

The disinflation cycle is well advanced on both sides of the Atlantic. While central bankers are wary of claiming victory too soon, it must be said that most of the way has been covered. In Europe, the Euro HICP (Harmonized Consumer price Index) reached 2.8% last January, compared with a high of 10.6% in October 2022, i.e., just over 90% of the way to the 2% target. In the United States, inflation reached 3.4% for the CPI (Consumer Price Index), while the Core PCE (Consumer Price expenditure Price Index) - the preferred measure of the US Federal Reserve (Fed) - reached 2.6%, confirming that inflation is heading in the right direction. Other measures of inflation are following the same downward trend. We should see a sharp fall in the Shelter component of US inflation over the coming months. This alone accounts for two-thirds of the inflation published in the United States, while rental price indices measured by estate agents have already fallen sharply for over a year.

CPI INDEX

The tensions in supply chains that fueled price rises during the health crisis have essentially disappeared. It is true that attacks on cargo ships in the Red Sea are forcing ships to take longer and more expensive routes, but these price rises are nowhere near the tensions experienced during the health crisis. Christine Lagarde, President of the European Central Bank, said in her recent speech that these transport costs represent only 1.5% of the price of finished products. Conversely, producer prices (PPI) are currently falling sharply, by around 10% in the Europe zone. This fall is due to the end of the energy crisis and the end of the restocking period. Logically, the price of manufactured goods is set to fall over the coming months, which will automatically weigh on overall inflation. However, prices in the services sector remain buoyant, and the risk of a wage-price loop is now the main concern of our major monetary authorities.

Monetary policy: change of course in sight.

The monetary policy tightening cycle has been particularly rapid and pronounced. It took the Fed just 18 months to raise its key rates by 525 basis points, and just over a year for the ECB to reach the 4% level, coming from negative interest rates. By its very nature, interest rate policy takes time to produce its effects. The lag effect is all the greater when agents are indebted at a fixed rate. In the short term, we can even observe an opposite effect. Available savings and corporate cash flow benefit from higher interest rates, while the cost of fixed-rate debt remains unchanged. The apparent interest rate paid by large US companies thus fell in 2023. Similarly, households saw their net financial burden fall in 2022, and the high levels of surplus savings accumulated during the health crisis reinforced the phenomenon. But like a supertanker, launched at full speed, which takes more than 10km to stop, the change of course in monetary policy will not show its effects until much later. This inertia means that monetary policy is highly uncertain, and central banks will have to cut interest rates sharply to avoid a recession.

Disappointing growth momentum in China

Among the emerging markets, it was Chinese growth that disappointed in 2023. Hopes of a strong recovery with the end of containment measures have been largely dashed by a deep-seated property crisis that is weighing on consumption. The budget balance is no longer contributing as much as in the past, and foreign direct investment flows have largely reversed. The mix of measures to support the economy is a delicate one, as we need to avoid repeating the excesses of the past and allow the Chinese economy to embark on a period of deleveraging. Although the economic surprise indices have recently recovered, the economic momentum remains fragile compared to historical levels. Weak consumer spending and excess capacity are weighing on prices to such an extent that China entered deflation last summer (a fall in the general price level).

The other emerging economies are showing much stronger momentum. Central banks have reacted more quickly than in developed countries, enabling them to post better inflation figures, notably in Brazil, India, and Indonesia. The momentum of consumption and investment is much more favourable.

Consumer Confidence Index - China

Increasing geopolitical tensions

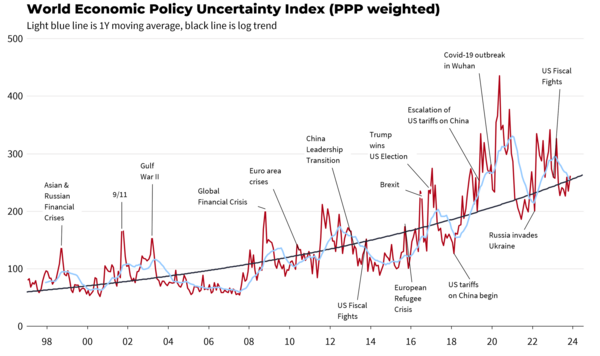

Geopolitical tensions will continue to loom large in 2024. The level of political uncertainty is further heightened by a packed electoral calendar. This year, it is estimated that 50% of the world's population will be called to the polls in over 60 countries. Geopolitical and trade tensions are likely to remain high. As conflicts spread, military action and trade confrontations multiply, leaving little room for diplomacy and international law. This anxiety-provoking environment is likely to persist, at least for a while, pending a new balance that is more collaborative or more coercive. This new situation reinforces the trend towards greater autonomy for economic zones and the reintegration of supply chains with a tendency towards relocation.

World Economic Policy Uncertainty Index

What strategies should we adopt?

Bond yields began to fall at the end of 2023 following the announcement of the monetary policy pivot by Fed Chairman Jerome Powell. The first-rate cut is expected in the spring and, in the absence of a shock to growth, a steady decline could begin. While the exact timetable remains uncertain, there is no doubt about the direction. In the eurozone, the faster decline in inflation and weak growth could speed up the timetable. Yields are currently attractive, with positive real yields (after inflation), and it is appropriate to extend maturities to crystallize rates at these attractive levels.

The change in policy direction should benefit the equity markets, offering valuation support and reallocation flows to the asset class. The US markets are benefiting from robust earnings momentum, with significant economic momentum and a source of endogenous growth through high exposure to the technology sector. In this respect, and despite the already impressive stock market performance, we continue to favour the AI theme. We are also optimistic about European equities, with a preference for growth stocks in the consumer sectors but also among the fine industrial companies. The property sector, which suffered greatly during the period of inflationary shock, could also stand out in a scenario of accelerating interest rate cuts. Japan appears to be on the way out of two lost decades. The rebound in productivity growth, the increase in female employment and the end of deflation all point to better days ahead for Japanese equities. On the other hand, we remain cautious on emerging markets, given the uncertainties overgrowth in China. Outside the traditional asset classes, we would like to favour secondary private equity funds within real assets to capture significant discounts. We would favour the private debt segment, which offers attractive yields combined with improved levels of real collateral. While it is important to stay the course, remaining invested and faithful to your investment strategy is necessary in 2024. Flexibility and selectivity in allocation will be the watchwords of this year.

The surprises of 2023 will give way to the surprises of 2024. Faced with these uncertainties, consumers appear to be better equipped, benefiting from a buoyant labour market and a fall in inflation. Equity markets should do well again this year, and fixed-income markets offer the prospect of comfortable returns. Flexibility will continue to be the order of the day if we are to adapt as best, we can to an uncertain and changing environment and take advantage of the surprises of 2024.