Moorea Fund - Serenity

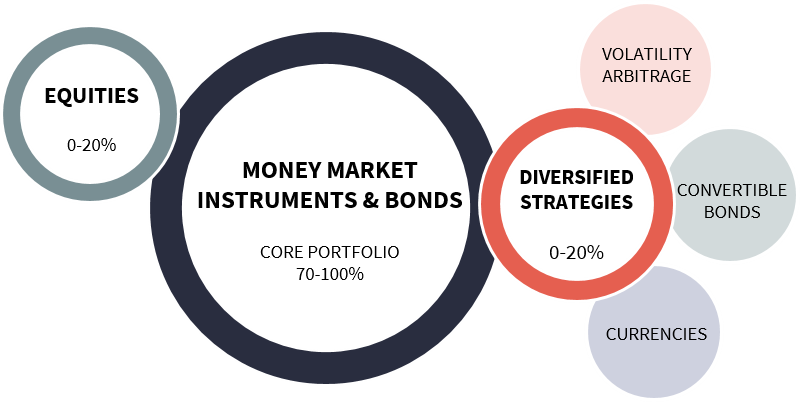

The investment strategy aims to deliver medium-term capital growth through a strategic asset allocation. The portfolio comprises at least 70% fixed-income products (money market instruments and bonds). The remainder may be invested in other assets such as equities and structured products, and in diversification strategies such as dividends and volatility.

A fund designed to meet private clients' high standards.

Key features

This strategy offers a real solution for diversifying a bond investment strategy

The fund management team’s objective is to give priority to fixed-income products, but with the flexibility to select investments that offer an attractive risk/reward ratio. As a result, the portfolio can make opportunist investments in equities and diversification strategies (up to 30% of assets). The flexibility of this mandate enables the fund managers to seize the best opportunities and ensure optimum diversification at all stages in the economic cycle.

A risk on/off methodology used to determine the appropriate level of risk

The portfolio managers and Societe Generale Private Banking’s strategists permanently track and analyse four global risk factors (market sentiment, global growth outlook, market liquidity and valuations) so as to determine the appropriate level of risk (Risk on / Risk off), which in turn is used as the basis for the asset allocation and portfolio construction.

| Share class |

|---|

Serenity Portfolio in a nutshell

The “Core Portfolio” (70-100% of assets) comprises money market instruments and bonds.

The management team invests in both investment-grade and high-yield government and corporate bonds, with no constraint in terms of rating, geographic area or maturity.

The equity allocation can vary between 0 and 20% of assets. The management team will invest in equities if opportunities arise.

Diversification strategies can account for up to 20% of the portfolio. These strategies are used to optimise the portfolio’s return as opportunities arise. Depending on market conditions, the investment team may use innovative strategies (volatility arbitrage, currencies, convertible bonds and/or others).

Performances

Past performance should not be seen as an indicator of future performance.

Associated risks

- Counterparty Risk: Refers to the risk of counterparty default resulting in non-payment. The fund may be exposed to counterparty risk through the use of Over The Counter (OTC) derivatives entered into by mutual agreement with a credit institution.

- Liquidity Risk: Refers to the possibility that the fund may loose money or be prevented from earning capital gains if it cannot sell a security at the time and price that is most beneficial to the fund and may be unable to raise cash to meet redemption requests.

- Credit Risk: Refers to the likelihood of the fund lose money if an issuer is unable to meet its financial obligations, such as the payment of principal and/or interest on an instrument.

- Operational Risk: It refers to a failure or delay in the system, processes and controls of the fund or its service providers which could lead to losses for the fund.

- Market Risk: Refers to the possibility for an investor to experience losses due to the overall performance of the financial markets.

- Concentration Risk: Refers to the risk of significant losses if the fund holds a large position in a particular investment that declines in value or is otherwise adversely affected, including default of the issuer.

Before investing, they must be aware that certain markets may be subject to rapid fluctuations and are speculative or lacking in liquidity. Accordingly, certain assets or categories of assets listed in the present document may not be appropriate for investors. In certain cases, investments may even bear an indeterminate high risk of loss that exceeds the initial investment made. Investors are therefore urged to seek the advice of their financial advisor or intermediary in order to assess the particular nature of an investment and the risks involved and its compatibility with their individual investment profile and objectives.